Investing a rental possessions shall be a terrific way to generate inactive income, especially if you already individual property you will be prepared to book away. However assets currently features home financing you happen to be settling, you can even question when it is you can easily so you’re able to rent out your house so you can clients instead of violating the borrowed funds arrangement.

The solution can be sure, however, there are specific considerations to remember. Keep reading understand what the individuals was plus the tools your may use so you’re able to take control of your leasing assets such as for instance good specialist.

1. Browse Mortgage Restrictions

There are many different brand of mortgage loans, instance traditional fund, FHA fund, USDA money, Experts Things (VA) financing, adjustable-speed money, and you may fixed-price mortgages. According to research by the method of you may have, check if the types of loan possess limits on the leasing aside the property.

dos. Carefully Review Your own Mortgage Contract

Look for mortgage restrictions (or no) on the mortgage deal, including information about how enough time to wait ahead of renting away, which so you’re able to notify if the probably book the home, and occupancy conditions. Normally, your home loan company assists you to book your home, but you will need to done several strategies to make certain your sit inside advice of arrangement. What the individuals is actually differ on your own financing sorts of and Wisconsin personal loans you may bank.

step 3. Pose a question to your HOA From the The Leasing Policy

Specific single-friends house and you will condos may be part of a home owners Connection (HOA), that may enjoys its policies towards the leasing.

When your house is an integral part of a keen HOA, ask if discover limitations toward renting to be familiar with. Additionally, query on which statutes the fresh new tenant are expected to abide from the shortly after went during the.

4. Relate to Regional Landlord-Tenant Laws and regulations

To prevent violating local ordinances, refer to local landlord-tenant laws to possess here is how in order to display screen applicants, collect rent costs and you may security deposits, avoid discriminating facing clients, and a lot more. When the planning enable it to be animals, look for laws and regulations on mental assistance and you can provider pet, as they enjoys additional protections one dogs.

5. Consider Resource Gain Consequences

In certain says, you should live-in the home to have a certain amount of ages to quit resource progress taxes, the income tax speed into payouts home owners helps make out of attempting to sell their property. If you’ve lived in the house or property at under 2 years, you’ll be able to no further become excused regarding purchasing taxes on the funding development.

Should i Give My personal Home loan Provider that I am Renting Aside The house?

Yes, you are doing have to alert your own mortgage lender that you’re given leasing your household prior to seeking tenants. Failing continually to exercise normally break new terms of the fresh new arrangement and cause high priced costs.

cuatro Techniques for Renting Out your Home

After you’ve informed your home loan company and you can received recognition to help you book out your household, the next thing is looking tenants. Here are some tips to cause you to a property manager and you may rent out your residence the very first time.

step one. Determine a competitive Book Price

Research leasing comps observe simply how much almost every other landlords is billing for similar functions near you. You can manually flick through local rental postings otherwise spend money on an Avail Book Price Research are accountable to score comprehensive information on local request, leasing comps, and much more in one report.

2. Establish something to collect Lease Money

The secret to rescuing time and money as a landlord is having a process positioned making it possible for tenants add book costs and other local rental charges on line. You need a rent range app to improve the method and you may track possessions accounting.

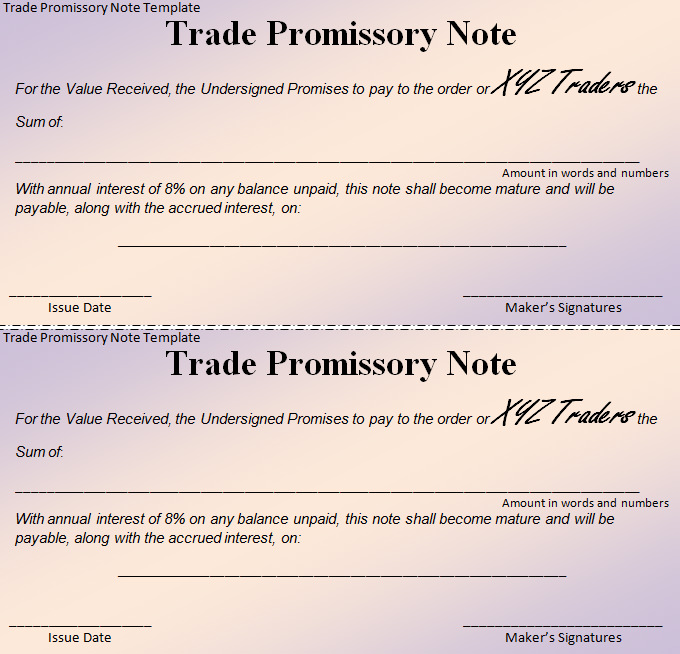

step three. Explore an attorney-Examined Rent Arrangement

When you have to simply take most tips to really get your financial lender’s acceptance to help you book your house, you should have a very good book in place to safeguard both you and your assets. If you find yourself unsure the best place to carry out a rent, you need a deck like Avail that offers attorneys-assessed rent agreement themes which can be condition-certain you need to include most of the locally-necessary conditions. You may want to carry out a rent amendment to help you legally tailor an present book.

cuatro. Prepare for Quick- and you will A lot of time-Title Vacancy

Within the a fantastic world, your home might be occupied constantly with minimal episodes regarding vacancy, but this doesn’t always be your situation. Local rental consult could be low needless to say days, or if you may be struggling to provides a tenant if you try addressing renovations or major fixes.

For this reason, policy for differing vacancy periods because of the installing a loans to cover your mortgage payment, property taxation, HOA costs (if relevant), and you may sudden repairs. You can do this from the totaling the expense your normally safeguards that have book costs and you may rescuing 3 to 6 months.

Rent Your property Particularly a professional That have Get

You can book your residence that have a mortgage, however it is crucial that you talk to their mortgage lender very first in order to avoid hiccups. Just after you’re willing to book your residence, you can make use of a home administration software program like Avail so you’re able to help save you money and time since a landlord.