Thinking about to buy another type of house? Navigating the realm of mortgage loans will be daunting, but knowing the ins and outs of traditional funds can make the travels convenient. In this topic, we are going to find out a traditional mortgage definition, its positives and negatives, and things to bear in mind when using.

Traditional Loan Meaning: Unpacking what’s needed

What’s a normal financing? Its one home mortgage that’s not insured or secured by authorities (for example lower than Federal Homes Administration, Department regarding Experts Issues, otherwise Institution off Farming financing software).

- Effective interest levels-fixed otherwise changeable;

- Fees name-fifteen or 30 years.

- Highercredit get

The minimum rating ranges out-of 620 so you’re able to 640, and better factors cause top interest rates. Your credit report shows the newest borrowing https://paydayloanalabama.com/courtland/ background, therefore a track record of prompt payments and you can in control debt administration bodes really.

- Readiness to help make the very first fee

Traditional finance allow for a down payment as high as step three%, in this situation, you should pay personal mortgage insurance coverage (PMI). This additional fee every month protects the financial institution in the eventuality of standard and lowers their payment.

- Maximum obligations-to-money proportion (DTI)

DTI try an economic signal you to definitely actions month-to-month debt burden compared to help you terrible monthly money. 43% ‘s the limitation DTI getting a normal financial, meaning that their monthly obligations money cannot meet or exceed 43% of your month-to-month pre-taxation earnings. It speaks for the power to carry out finances and you may pay off borrowing from the bank.

- Obtaining a steady income

As well as the the second points, lenders think about this new frequency of your own paycheck or other earnings. Your capability to repay a cards more a long several months hinges on your own financial stability. A two-12 months employment background can be seen as a sign cash stability.

Papers criteria

Now that you will find responded the question, What is a traditional mortgage? let’s focus on the expected records. While the mortgage landscaping changed since 2007 subprime drama, the essential records requirements for antique money will always be relatively intact.

- Home financing software is an official mortgage demand, tend to accompanied by an operating percentage.

- Records guaranteeing earnings:

- Invoices for wages (income getting a month, earnings to your latest year);

Old-fashioned Mortgage Selection

What’s old-fashioned investment definition for almost all People in america? Stability, self-reliance, and you can favorable terms. It’s an effective option for prospective property owners. Therefore, why don’t we speak about conventional financing options.

Comply with Fannie mae and you can Freddie Mac advice, which have loan restrictions (such as for example, $726,two hundred inside the 2023). Suitable for a borrower having a card who would not require a big financing.

Meet or exceed the utmost restrictions lay from the Fannie mae and Freddie Mac computer. This is going to make this 1 more risky to possess lenders, so individuals that have such as for instance fund constantly face stricter degree criteria. But not, large finance do not constantly have high prices. This kind of loan is made for consumers who need much more money for more pricey a house.

Are given because of the financial and gives alot more liberty to qualify (eg, lower down repayments). Even so they could have large rates. It is a loan you to stays in the bank that is perhaps not sold on the fresh new supplementary markets.

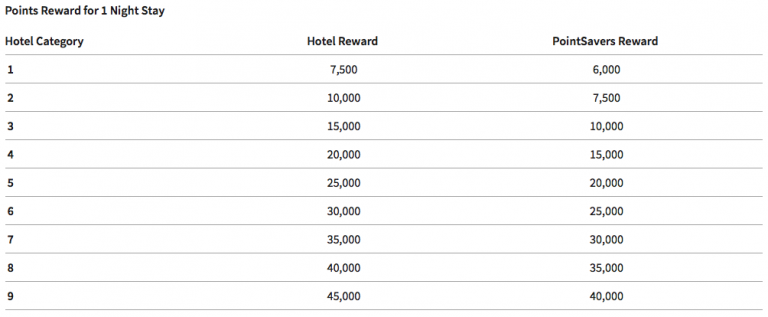

Bring balances within the whole age of borrowing validity due to the fact interest rate remains undamaged. It includes predictable monthly obligations, it is therefore the greatest selection for a debtor whom philosophy ??clear standards and you will cost management.

Provide a lower initial interest rate than simply fixed. They’re able to change during the period of credit authenticity. This really is very theraputic for a borrower just who intends to refinance or sell our home before the end of your own basic months at a fixed price. But not, consider the risks is important, since your monthly payments get raise, while making cost management hard.

Weigh advantages and you will Cons regarding Conventional Money

Studies of key pros and cons from old-fashioned financing and consider them facing your financial situation and you can specifications allows you to determine if this type of financing is the correct choice.

Experts

The fresh deserves is unignorable, while they let the borrower to build collateral of the purchasing good house right away. Yet not, like any credit provide, this type of mortgage keeps particular disadvantages.

Disadvantages

Remember that never assume all antique finance have all these downsides. Some loan providers bring far more versatile terminology, and you may market criteria affect accessibility and you can prices.

Latest Think

Very, what’s a traditional mortgage? For individuals who understand antique home loan meaning, it gets obvious this particular also provides possible home residents freedom and versatility of choice. You could pick this new functions need, comprehending that you can access positive conditions and you can secure desire prices.